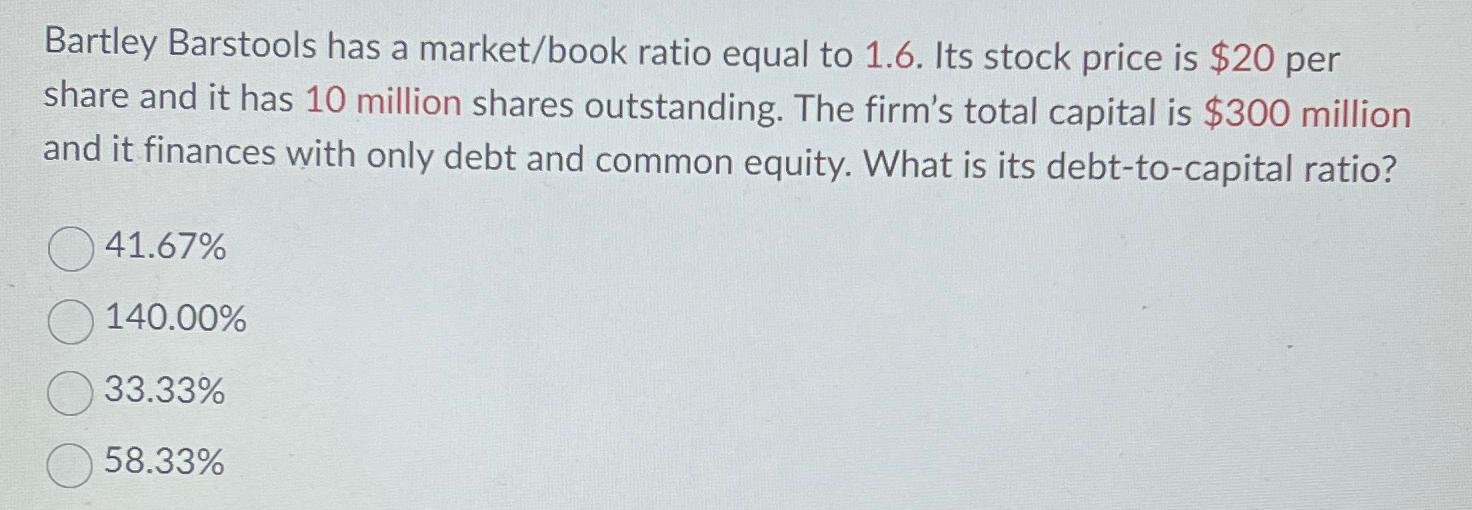

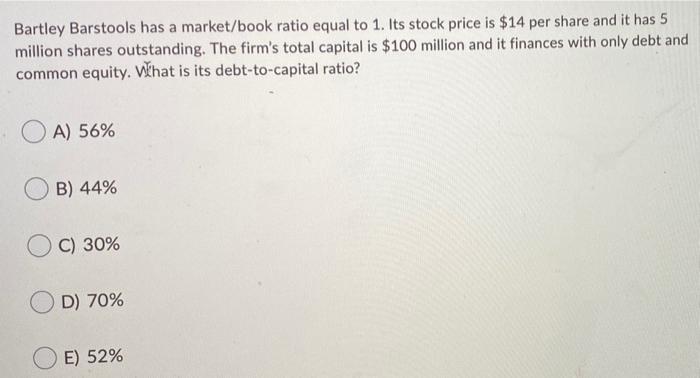

SOLVED: Bartley barstools has a market/book ratio equal to 1. Its stock price is 14 per share, and it has 5 million shares outstanding. The firm's total capital is125 million, and it

FIN assignment 3.docx - Students Name: Thao Thach Tran ID:1490321 FIN 3331 ASSIGNMENT 3 4-1 DAYS SALES OUTSTANDING Baker Brothers has a DSO of 40 days | Course Hero

SOLVED: Bartley barstools has a market/book ratio equal to 1. Its stock price is 14 per share, and it has 5 million shares outstanding. The firm's total capital is125 million, and it

SOLUTION: Bartley Barstools has an equity multiplier of 2.4 and its assets are financed with some combination of long-term debt and common equity What is its equity ratio? What is its debt

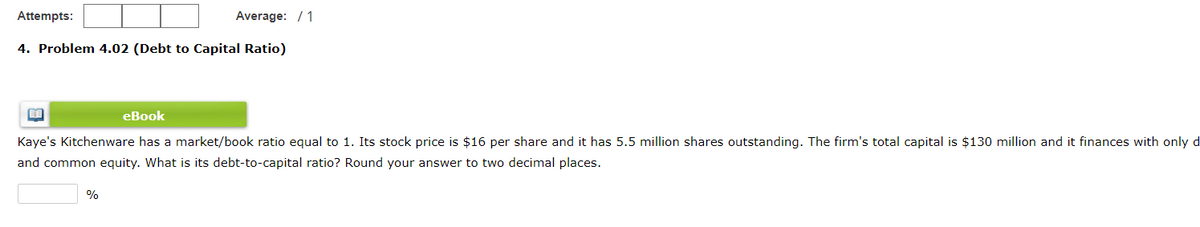

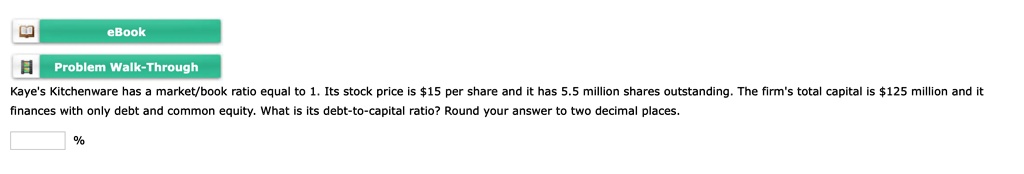

Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is $14 per share and it has 5.1 million shares outstanding. The firm's total capital is $125 million and it

SOLVED: Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is 15 per share and it has 5.5 million shares outstanding. The firm's total capital is125 million and it

FIN 3331 Homework 2.docx - Hannah Chan 1505763 Homework Two: Chapter 4 4-1. DAYS SALES OUTSTANDING: Baker Brothers has a DSO of 40 days and its annual | Course Hero